If you have started or are thinking of starting a business, you may not have really thought too much about the type of that business. You probably should — it will make a difference in your future and how you work and fund it.

There are many ways to think about this but I like to break them down into two broad business model types, lifestyle (or non-scalable) and what I call scalable businesses.

Non-scalable or Lifestyle Type Businesses

Lifestyle businesses can be further broken down into 1) Hobby Business where you go into something that you are already doing in your spare time for free. You love the subject and would probably spend money on it anyway. Of course the problem often becomes that it is hard to continue to love your hobby when you make it a business. Or 2) a Lifestyle Business; which is typically the kind of business that allows you a degree of freedom with the primary aim of sustaining a specific income level or a foundation from which you can enjoy a particular lifestyle. By definition, they have limited scalability and growth potential for if they did they would destroy the very lifestyle that their founders set out to create. The final type is a 3) Franchise Business. It can also be great business for their owners and an excellent alternative for an aspiring entrepreneur who may have little if any experience in startups. They usually have a proven business model thus reducing their risk; however they also can require a significant initial investment and ongoing royalty payments to the franchisor.

These Lifestyle Businesses can make a wonderful business for their owner/operators; however they are much less likely to be able to generate enough profit to be able to pay back anyone other than their founders. If you are the only investor, the promise of being your own boss could very well be worth that trade-off (but don’t try to get it funded by any Angel or Venture Capital firm).

Scalable Businesses

The other broad category of business model is one that we need to drill down a little further into and it what we can define as scalable. A scalable business is a venture that you or I as investors (and you are an investor if you are an entrepreneur/founder) have the best chance of getting a return from our investment. (I would also define it as a business that you can make money in while you are asleep.)

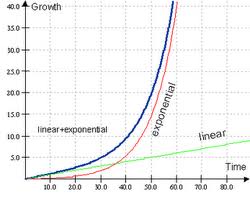

By definition, a scalable business is one where the operating margin increases as the company’s revenues grow (e.g. increased revenues cost less to deliver than current revenues). In other words, the operating margin increases as the company’s revenues grow — or 2 times 2 equals more than 4.

It is a scalable business that is of most interest to Angel and Venture Capital Investors and may be for you as well. In any case, it is one that you have to understand as an entrepreneur as well, if you ever think that you will need more capital than you can deploy or create.

This is another fundamental but very important concept and truth to a startup that goes along with this: The minute that you accept outside capital into your business you have to understand that you have a responsibility to earn a return to those investors whom put their faith in you.

With LeanLogistics, relatively early on we had the understanding that we would probably need more capital then what we could afford or could generate to be able to competitively grow. We also knew that the minute we accepted that outside capital we would have to either have 1) a liquidity event of some sort or 2) have to be able to generate enough profit to be able to offer our outside investors an opportunity to receive a return on their investment (not to mention ours). We brought in outside angel capital that gave us the runway to success, never looked back (well, maybe once) — and returned them handsomely when we later sold to an international public company.

Return on Investment (ROI)

Taking equity investment from outsiders is a double-edged sword though. On one hand, while an entrepreneur would rather be able to drive the business in any direction that they want (including into the ground); having the involvement of seasoned investors can help you navigate some very rough water. I have found it much easier to learn from other people’s mistakes than my own (and I have had many of those). In addition, leveraging their domain, networking, sales and marketing, and business experience can make the path to success much smoother. You can refer to an earlier post on The Lean Startup where I talked more about ROI and the importance of equity alignment.

Very few of the great companies, especially in the tech space, were started and grown without the benefit of outside equity capital. Be careful not to inadvertently put up barriers to that possibility thru either your associates, corporate structure or the complications of your capital table (both topics for further exploration). You may never know when you have to “pivot” your business model.